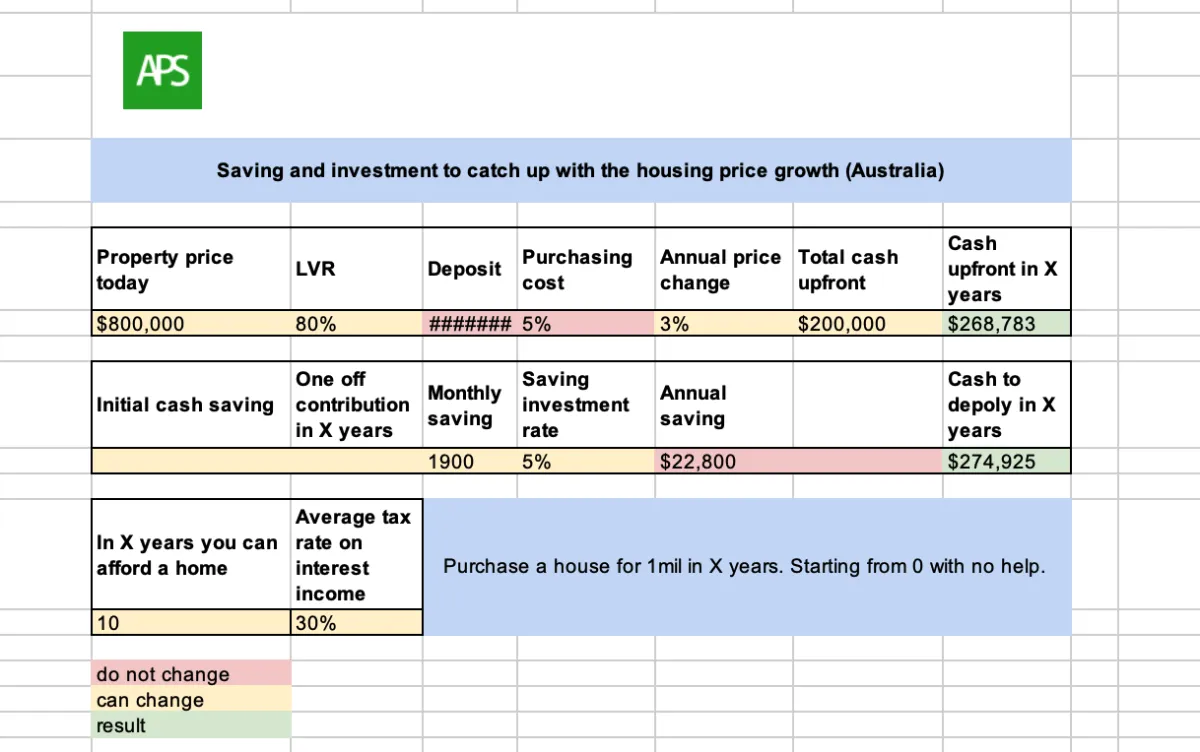

Deposit Calculator (.xlsx)

Save to catch up with the housing price growth

Most Australians find their salaries can't keep up with property prices. The majority of Australians are earning less, at a slower pace, than property values are rising. So, how can everyday people effectively save, manage their savings, and get into their first property sooner?

For detailed guidance, watch our YouTube video:

How does your income compare? 3 steps for a struggling Australian to buy the first property [APS067]

✅ Free to download

✅ Free to use forever

✅ Share with your friends

✅ Proudly created by APS

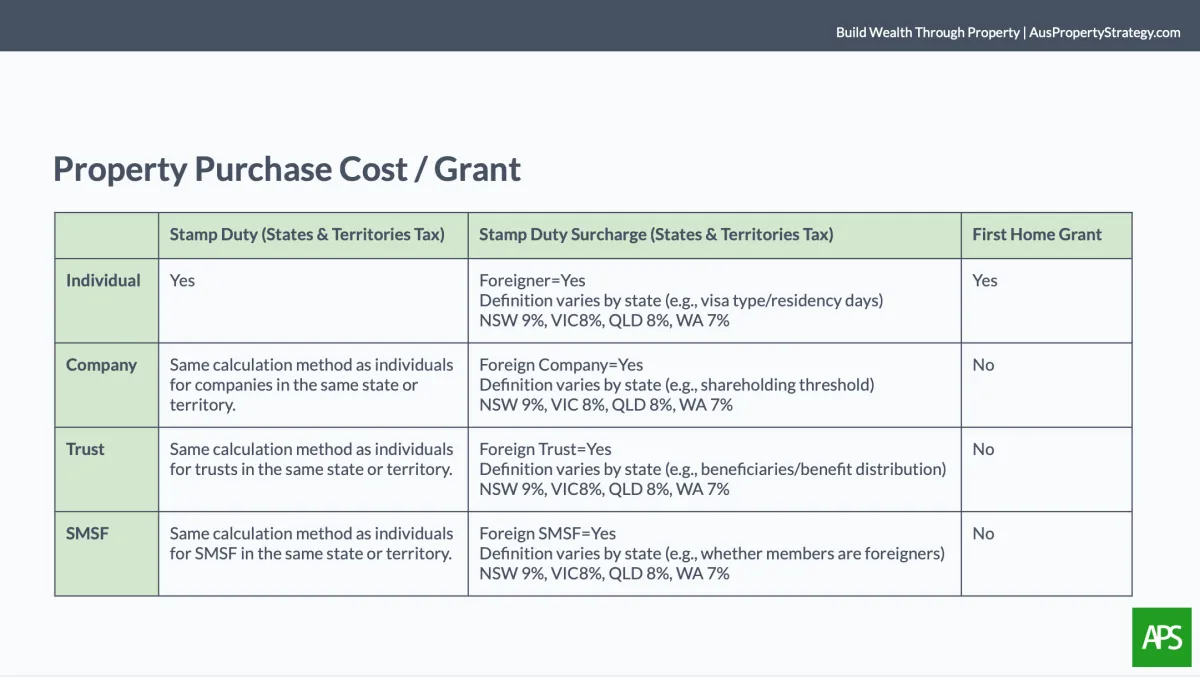

Ownership Structure (.pdf)

Which entity to use to buy an investment property?

In Australia, property can be held under various structures—such as personal name, company, trust, or self-managed super fund (SMSF). If you’re unsure which entity to use when purchasing a property, unclear about the tax implications across different states and territories, or concerned about how entity choice might impact your borrowing power—then this guide is a must-download.

This handbook outlines all the key factors property investors need to consider when choosing an ownership structure. Traditionally, making this decision requires input from an accountant, solicitor, and mortgage broker. This worksheet helps you save significant time and professional fees by putting the essentials in one place.

For detailed guidance, watch our YouTube video:

What entity to use? The key issue most property investors ignored. [APS076]

✅ Free to download

✅ Free to use forever

✅ Share with your friends

✅ Proudly created by APS

Disclaimer|AusPropertyStrategy website, video, audio, article and publication contain information about property investment and business operations. The information is acquired from trusted sources and is not advice and should not be treated as such. You must not rely on the information as an alternative to legal, financial, taxation, and accountancy advice from an appropriately qualified professional. If you have any specific questions about any legal, financial, tax, or accountancy matter, you should consult an appropriately qualified professional. To the maximum extent permitted by applicable law, we exclude all representations, warranties, undertakings, and guarantees relating to the information. Without prejudice to the generality of the foregoing paragraph, we do not represent, warrant, undertake or guarantee that the information on the website, video, audio, article and publication is correct, accurate, complete, or non-misleading; that the use of the guidance will lead to any particular outcome or result; or in particular, that by using the information you will receive investment return. The content is not designed to promote any financial product or influence anyone to make a financial investment decision accordingly. DO NOT buy, sell or not buy, sell any Australian financial product or service that needs an AFSL just because somehow you are influenced by our content. The use of our website and the consumption of our content is considered an agreement to the above terms.